cattle recovery and corn posturing ahead of report

So during drive time today I was thinking through strategies for approaching the next few months of trading in the grains. As previously mentioned, August is the critical month for beans. Should there be a run-up in beans the corn will follow to some degree. Cash grain is still extremely cheap across the corn belt and it may very well be that way come November and December. With Dec corn futures currently trading over 260 and still possessing the potential energy to jump over the 270 threshold (without too much effort), this market is setting itself up for August to be an initiation point for a seasonal trade.If corn is at 270+ in mid to late August and a trader sells the market short, this may be an opportunity.

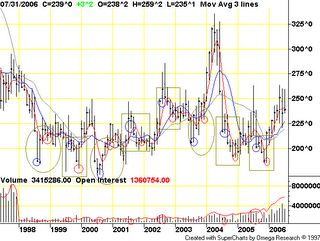

This chart is from tradingcharts.com:

Looking at the monthly chart for corn... out of the most recent 8 years, 3 of those years have had an August low lower than the December low. The remaining 5 years have a December (harvest time) low that is lower than the August low. So 62.5% of the time the December low is lower than the August low. The August low is circled in blue and the December is circled in red. I put boxes around each of the years that the pattern of lower December lows worked and circles around the years it didn't work.

- 1998: 8/31 187.00 12/31 207.50 diff +20.50

- 1999: 8/31 201.25 12/31 180.00 diff -21.25

- 2000: 8/31 174.00 12/31 204.25 diff +30.25

- 2001: 8/31 220.25 12/31 205.25 diff -15.00

- 2002: 8/31 245.00 12/31 231.25 diff -13.75

- 2003: 8/31 206.00 12/31 229.00 diff +23.00

- 2004: 8/31 215.25 12/31 191.00 diff -24.25

- 2005: 8/31 200.00 12/31 186.00 diff -14.00

The math was in my head so this is only a ballpark data set. But observations are:

- 24.6 cents is the average loss differential for a short position in the three years the December low was higher than the August low.

- 17.65 cents is the average gain differential for a short position in the five years the Dec low was lower than the August low.

The bottom line is that there is a potential seasonal trade before us. More time should be invested into the different permutations.

One more thing about corn...

Another observation in passing is that looking at the December lows (red circles on the price chart), I noticed that buying in December for an intermediate term trade seems to have a high probability of success. Everyone knows that the harvest usually brings low prices because everyone has corn, for example, and the supply/demand forces forces depress price, but no one knows how low that "harvest low" will be and how high the trade could get between now and that low.

A note about cattle

The recovery in feeders on Friday wasn't enough to give too much ammunition to the bulls. It's still quite possible these things could tumble hard. 115.500 is a key area. Be careful as recoveries and declines come quickly.

Trading Account Management

I have no idea how well-funded the average speculative account is, but I think it can reasonably be argued that one of the reasons that 9/10 people lose in futures is due to lack of a trading plan. Of course, there is the "human emotion" variable that skews reality and causes irrationality, but let's just say that a person has the ability to stick to a plan. Then the only obstacle that remains is to develop a sound trading plan! Lack of sufficient funding for an account (a common reason why someone always seems to have a brother in-law that lost his tail in pork bellies...) only becomes an issue if the "worst case" hasn't been worked through and accounted for. If you understand and accept your maximum exposure on a given trade, then insufficient funding is a non-issue.

The problem seems to be that people do not have a predefined exit point in the event that a trade does not go their way (in the requisite time), so they let the losses continue to accrue. As the old adage goes, "the market will do exactly what frustrates the most traders." When bad things continue to happen to your trade, your hopes that the trade will recover turn to fear that it won't even get close. But the trader hangs on, hoping to salvage of the original capital. Before long, the trader runs out of money and taps out at precisely the worst exit point. Shortly thereafter, the market turns around and does exactly what the trader had originally foreseen! If only he could have hung on a little longer!! Wrong! That sentiment will cause much pain. No matter if your account is $50,000 or $2M, the risk threshold for each trade should be a predetermined factor from which the trader does not deviate.

I mentioned irrationality -- aka deviating from a plan and pulling the trigger prematurely (or too late) on an entry or exit. As they say, "plan your trades and trade your plans." The market doesn't have it out to get you. The market could care less whether you win or lose a fortune. It's the most disconnected and unbiased mechanism that has the ability to teach a person volumes about their mental fortitude.... you are, after all, your own worst enemy. Having a plan before entering a market requires work. It's worth it. Do the research to find markets with:

- high risk to return ratios

- minimal loss with stop placement

- opportunity to participate in larger (intermediate to longer-term) trend at a value

- chance to diversify other trades

0 Comments:

Post a Comment

<< Home