corn recovers, sugar tanks, and cattle churn - august 4, 2006

The cattle market has been moving back and forth for the past couple of weeks not really having a breakout on either side. In Thursday's trade, a (very fast) breakdown to the 112.700 level didn't last very long and prices for the September contract closed at 114.00. With the strong corn rally to 265.50 basis Dec in the overnight trading session, cattle may struggle on Friday. That, coupled with the tendency for cattle to find a bottom seasonally in the near future could apply the needed pressure to test some support levels.

Feeder cattle are testing the bottom of a shelf and if they plung through the fall could be fast and hard. If the corn rally continues that the probability of this threshold being broken increases. I don't believe it would take much to set-up a sharp sell-off. That said, if support holds then we've seen in recent trading sessions how quickly cattle and rebound.

A sell off in sugar prompted some heavy losses in recent trading sessions. The October contract may look to 14c for support. If the downward momentum continues, then this market could take some time finding support in lower layers.

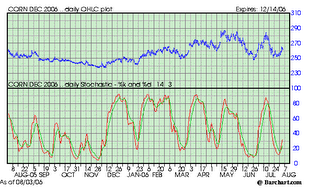

The corn rally overnight is interesting for a number of reasons--most of which have been noted in this blog at one point or another, but here's the thing: the report due out August 11 has the market posturing itself for the news. Premium is being factored in for the potentially bullish news. How much higher could we see this market move? No one has a clue. Bottom line is this: we had a run-up early in the season, had a July "gift" as I like to call it with Dec corn as high as 284 and now we're back in the mid-260s coming off of recent lows in the 250 area. Looking at this market from the perspective of both a futures and options trader is intriguing.

- as bullish sentiment continues to build, the premium for put options below the markets by 20-30c will become a bargain-basement value

- seasonal trends tell us that highs are rarely made at harvest time, which could mean that a selling opportunity may soon be upon us.

Stochastics reveal that the oversold territory has quickly resulted in a recovery, which could be indicative of an extremely deeply-planted support shelf that will be a tough nut to crack on the downside. Demand levels are high, nervousness about carry-out is high, and the potential for some western cornbelt yield damage has made enough nervous to prevent the slide thus far. Crop conditions reports, weather, and the upcoming production report are weighing on traders' minds.

0 Comments:

Post a Comment

<< Home