feeder cattle notes 8/22

feeder cattleThis market is toying with the high with flat resistance at 118.25. Today it closed down after Monday's impressive strength. If this market can overcome the nearby hurdle on the upside, then there's no telling how far it could ascend, but, on the flipside, we're overextended and the probability exists for a hefty setback. The danger of shorting a market like feeders right now is there is no chart precedent for a resistance level above the recent highs. If 118.25 is overtaken, then any buy-back stop (covering a short) would likely be hit. Again, markets like this can be vacuous in nature.

- Some markets start to feel like a reckoning day is near and this may prove to be an example.

- The picture is reasonably bearish for the current price levels to be maintained. The talk is centered around regaining export demand and continued strength in the domestic market. Any faltering with these variables would likely result in at least a sign of that reckoning.

- From the technical perspective, the intermediate-term uptrend is intact but the overhead resistance is substantial.

- One could make an argument for initiating a short position to play the probability of at least a minor correction to the intermediate-term uptrending line. Bearish fundamental news could precipitate a breach of the uptrend and cause a significant tumble thereafter.

sugar

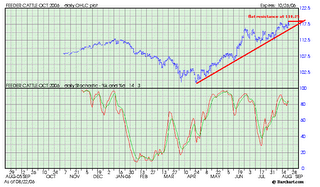

The October contract is hovering in the 12c area and could soon break through that key barrier. If it does then the vacuous area (noted in previous posts) could provide a hard and fast dive to wrap up this retracement. Be patient for this one to break through 12c. My short position is a few weeks hold and it's definitely paid to only update stop placement using significant resistance areas.

A habit I've been reasonably successful of moving away from is becoming very comfortable with a profit because I feel that a market has been "generous" to me and thus setting my profit-protecting stop closer than the chart tells me to. This unnecessarily limits profits--though some would argue that is allows for the trader to "give back" too much of the original profits I have actually found results to be much to the contrary. Using this stop placement method with the right markets has allowed me to catch the last and often best thrust of a move.

The reason I say "the right markets" is because there are absolutely certain markets in which this methodology is just asking for repeated setbacks. Swing trades often require a very defensive posture to protect accumulated profits from the trading channel. Positional trades require patience and commitment to the support and resistance levels. Different tools for different markets.

It, again, boils down to planning your trades and trading your plans.

0 Comments:

Post a Comment

<< Home