sugar, corn, and gold sunday, aug 13

Looking at the corn chart, it seems possible that trade could break through support in the 237.75 area--though it doesn't seem terribly likely at this point. Evening trade tonight 8/13 has been as low as 237.25, but it quickly rebounded. The early part of the coming week may be telling of the intermediate-term direction of this market. Friday's high per acre yield estimate caused the trade to factor out about 14c from the market. With the demand factors still in place for corn, there could be a nice buying opportunity coming up. This price for corn coupled with the weakness of the dollar makes the US corn a value buy for many other markets in need of corn. Ours is cheap right now.

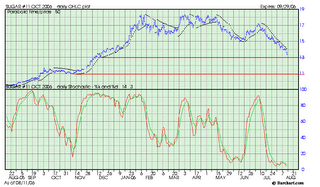

The sugar market may hit a vacuum soon with not a lot of chart barriers between close on Friday in the mid-13c range and 11c. Of course, nothing goes straight up or straight down for long. This has been a weak one lately and I'm going to hang on to the short for the time being.

Gold is weaker tonight, likely because of the peacekeeping action announced by the UN that is slated for Monday. This market has been churning for some time now. It's lack strength on some pretty turbulent news could be indicative of underlying short to intermediate term weakness. We've seen about $25 taken out of the market recently. It could only be the beginning of a larger dip, or the bottom end of the trading channel. As they say, bull markets need fed.

December 240 corn puts may have some strength early in the week. I don't want to let these diminish from the recent highs because they could churn back to semi-neutral territory if the corn market revives somewhat. Be active with these Monday and Tuesday for possible exit strategy.

Gold calls may be a value buy early in the week. Watch the wide trading range carefully.

December coffee is resting on the upward sloping trendline. If it doesn't hold, then the contract could slip into the 105 neighborhood. Stochastics show a market on the verge of being overbought--perhaps the trade is feeling a shaky foundation of support. If support holds, then the move has potential to be quite strong.

0 Comments:

Post a Comment

<< Home