sugar, feeder cattle, and corn notes august 6

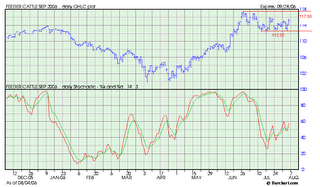

Feeder cattle could have more strength in the coming week. The September contract has been bouncing around a lot lately and has significant resistence at 116.00 and at 117.50. Both of these areas are key... getting past the 115.50 has also been challenging lately. Last week the contract dipped into the 112.70 ballpark and came roaring back. If this contract cannot close above 116.00 in the near future then it could be looking at significant downside pressure. Right now it seems to be hanging in a trading range of 112.50-117.50, while that's an expensive range a breakout on either side could be very noteworthy.

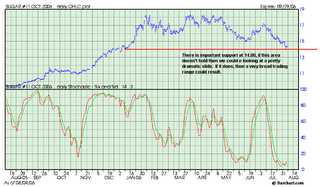

The sugar market sold off last week. Looking at the chart, the 14.00 area holds the key support line. A breach of this price area could perpetuate a dramatic slide. If a strong rebound from this support results, then we could have some degree of recovery or the beginnings of a very broad trading range.

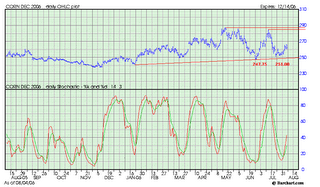

Lastly, looking at corn, this evening's trade is down 2-3c at 259.50 for the Dec contract. The chart shown below illustrates the resilience of corn as it rebounds from support. It does, however, seem to be stalling this time. The question that's on everyone's mind is "how will the market react to the USDA report coming out 8/11. If it's bullish, then you can bet on a run for previous contract highs. If it's bearish then we may finally see a breaking down of support that's held rock-steady in the 248-252 level.

0 Comments:

Post a Comment

<< Home